How to Choose the Perfect Payment Solution in 2025

Selecting the right payment solution is crucial for businesses aiming to optimize financial transactions. A robust system ensures secure, swift, and seamless payment processing, fostering customer trust and satisfaction.

Understanding Payment Solutions

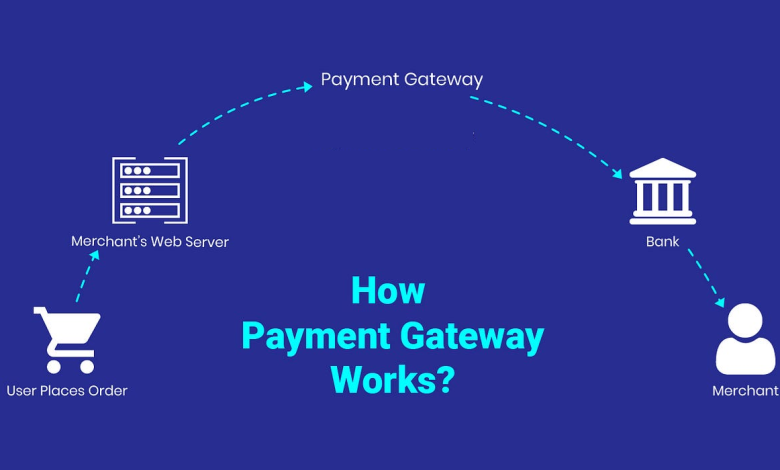

To make an informed decision, it’s essential to grasp how payment solutions function:

- Transaction Initiation: The buyer selects a product/service and enters payment details.

- Data Encryption: The system secures buyer information during transmission.

- Approval Process: Data is sent to the processor, which contacts the buyer’s bank for validation.

- Response and Finalization: The bank’s approval completes the transaction, transferring funds to the seller.

Why Payment Solutions Matter

Payment solutions enhance online transactions by ensuring:

- Fraud Prevention

- Data Encryption

- Support for Multiple Payment Methods

- Seamless User Experience

Key Factors in Choosing a Payment Solution

1.Global Reach & Local Payment Support

- PayPal: Ideal for international transactions.

- Stripe: Supports diverse local payment methods.

2.Easy Integration

- Square: Simple setup for e-commerce and POS.

- Net: User-friendly and adaptable for all business sizes.

3.Diverse Integration Options

- Adyen: Unified platform for online, mobile, and in-store transactions.

- Worldpay: Flexible integration for various business models.

4.Reliable Customer Support

- Braintree: Excellent support and troubleshooting resources.

- Klarna: Dedicated account management.

5.Fast Fund Settlement

- Skrill: Quick settlement for fast cash flow.

- 2Checkout (Verifone): Competitive processing times.

Introducing Paykassma

What is Paykassma?

Paykassma is an advanced payment platform facilitating Peer-to-Peer (P2P) and Peer-to-Customer (P2C) transactions across multiple regions.

Key Features of Paykassma

- Global Payment Method Coverage: Paykassma supports a wide range of payment methods, including those popular in India (UPI, Paytm, PhonePe by number, IMPS), Bangladesh (bKash, Nagad, Rocket), Pakistan (EasyPaisa, JazzCash, BankAlfalah), Kenya (M-Pesa), Sri Lanka (lPay), Uzbekistan (Payme, Uzcard, Humo), Tunisia (d17), Brazil (PIX), Mexico (SPEI), Nepal (Khalti, eSewa), Cambodia (Wing), Myanmar (Wavepay).

- Customized Solutions: Tailored to business turnover and industry needs.

Setting Up a Paykassma Account

- Manual Account Creation: Personalized setup based on business needs.

- Customization: Aligns with transaction volume and industry requirements.

User Feedback on Paykassma

Customers appreciate its ease of use and wide payment support. Platforms like Trustpilot and Sitejabber offer insights into user experiences.

Additional Features: Virtual Credit Cards

Benefits of Virtual Credit Cards

- Convenience: Instant generation for specific transactions.

- Security: Disposable numbers prevent fraud.

- Flexibility: Manage multiple cards effortlessly.

Paykassma’s Virtual Card Features

- Multi-Platform Use: Works with Google Ads, Facebook Ads, etc.

- 3% Cashback: On all transactions.

- Zero Fees: No deposit, withdrawal, or decline charges.

- Team Access: Corporate-friendly features.

- Quick Setup: Easy onboarding in a few clicks.

Conclusion

Selecting a payment solution in 2025 requires evaluating factors like global support, integration ease, customer service, and settlement times. Paykassma stands out with its diverse payment options, tailored solutions, and virtual credit card features. By considering these aspects, businesses can enhance their transaction efficiency and drive growth.