The Challenges of Measuring the Impact of Green Bonds

Green bonds have emerged as a crucial instrument in sustainable finance, aimed at funding projects that contribute to environmental sustainability. However, accurately measuring the impact of these bonds presents significant challenges. Visit zentrix-ai.com/, an investment education firm, is essential for investors seeking to avoid potential profit losses by understanding these complexities. This article delves into the issues involved in assessing the environmental benefits of green bonds, exploring topics such as inconsistent reporting standards, additionality, greenwashing, and the role of technological innovations.

Overview of Green Bonds

Green bonds are debt securities specifically earmarked to finance projects with positive environmental outcomes. These projects range from renewable energy installations to green buildings and sustainable agriculture. The market for green bonds has grown exponentially, reflecting a broader trend towards sustainability in the financial sector. Yet, despite this growth, the challenge of measuring the actual impact of green bonds on the environment remains a persistent issue.

Complexity of Environmental Impact Measurement

One of the fundamental challenges in measuring the impact of green bonds lies in the diversity of projects they fund. Each project type—be it a wind farm, a solar plant, or a green infrastructure project—has distinct environmental outcomes, making standardized impact measurement difficult. Additionally, geographic and sectoral variations add further complexity. For instance, a renewable energy project in a developing country might have a different impact than a similar project in a developed country due to varying baseline emissions and energy needs.

Challenges in Data Collection and Transparency

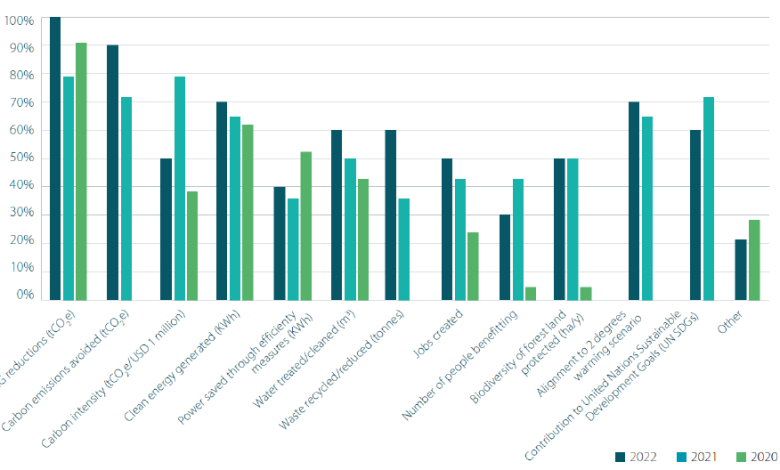

Data collection is another significant hurdle in impact measurement. The lack of standardized reporting frameworks leads to inconsistent disclosures from bond issuers. Different issuers may use varying methodologies to calculate the environmental benefits, resulting in data that is not comparable across projects or issuers. This inconsistency hampers investors’ ability to accurately assess the environmental impact of their investments.

Moreover, conducting a thorough lifecycle analysis of green projects is often challenging. Many assessments focus only on the operational phase of a project, neglecting the environmental costs associated with construction, maintenance, and decommissioning. This oversight can lead to an incomplete picture of the project’s true environmental impact.

The Issue of Additionality

Additionality is a crucial concept in measuring the impact of green bonds. It refers to the extent to which a project funded by a green bond contributes to environmental benefits that would not have occurred without the bond’s financing. Assessing additionality is complex because it requires a counterfactual analysis—estimating what would have happened in the absence of the green bond.

For example, if a green bond finances a solar power project that would have been built anyway due to existing regulations or market conditions, the additionality of that project is low. This makes it difficult to argue that the bond has contributed significantly to reducing carbon emissions. Therefore, accurately measuring additionality is essential to determine the true environmental impact of green bonds.

Risk of Greenwashing

Greenwashing is the practice of presenting a financial product as more environmentally friendly than it actually is. This risk is particularly high in the green bond market due to the lack of universally accepted standards for what qualifies as a “green” project. Without stringent criteria and verification processes, there is a risk that bond issuers may exaggerate or misrepresent the environmental benefits of their projects to attract investors.

To mitigate this risk, regulatory bodies and independent organizations have introduced guidelines and certification schemes. For instance, the European Union has developed the EU Green Bond Standard, which sets clear criteria for green bond projects and requires third-party verification of the environmental impact. However, the implementation and adoption of such standards are still in progress, and the effectiveness of these measures in preventing greenwashing remains to be fully tested.

Technological and Methodological Innovations

Advances in technology and methodology offer potential solutions to some of the challenges in impact measurement. Big data analytics and artificial intelligence (AI) are increasingly being used to collect and analyze large volumes of environmental data. These technologies can help standardize impact reporting by providing more accurate and real-time assessments of environmental outcomes.

For example, satellite imagery and AI can be used to monitor deforestation in real-time, providing tangible evidence of the impact of green bond-funded reforestation projects. Similarly, blockchain technology is being explored as a tool for enhancing transparency and traceability in the green bond market, ensuring that the funds are used as intended and that the reported impacts are verifiable.

Future Directions and Recommendations

To improve the measurement of green bond impacts, several steps need to be taken. First, there is a need for greater standardization in reporting frameworks. This could be achieved through international collaboration on developing unified standards that apply across different jurisdictions and sectors. Second, enhancing investor engagement is crucial. Investors should demand greater transparency and rigor in impact reporting, which will, in turn, push issuers to adopt better practices.

Finally, technological innovations should be embraced to improve data collection, analysis, and reporting. By leveraging the latest advancements in AI, big data, and blockchain, the green bond market can enhance the accuracy and reliability of impact measurements, thereby building greater investor confidence and supporting the continued growth of sustainable finance.

Conclusion

Measuring the impact of green bonds is fraught with challenges, from inconsistent data collection to the risk of greenwashing. However, with the right regulatory frameworks, technological innovations, and investor engagement, these challenges can be overcome. As the green bond market continues to evolve, improving the accuracy and transparency of impact measurement will be essential to ensuring that these financial instruments truly contribute to environmental sustainability.